JOT and PMJ intend to merge, seeking synergy on a global scale in their field of business. The merger should take ef-fect in September, whereby the greatest supplier of all kinds of equipment for automation in the PCB assembly process will be formed. The name of the newly forged company should simply be: JOT Automation Group Plc.

According to the merger program, Jorma Terentieff (managing director of JOT), shouldbe elected as CEO of thenewly composed commerce. The board of directors willbe formed by Mika Kettula, Markku Jokela, Niilo Pellonmaa and Jorma Terentieff. Juha Sipilä will be elected chairman of the board.

The heat is on

No doubt, the race is on for globalization in different businesses around the world. Especially companies in Europe, engaged in the area of equipment for electronics production, are often not the biggest ones compared to their counterparts in the U.S. or in Japan. Besides, to compete with them on both a global scale and in their home markets, European vendors are in need of a powerful network of representatives overseas, supported by the companies‘ own local facilities over there. On one hand, this kind of strategy is necessary to open up a company to international markets to successfully capitalize its expenses in R&D, production floor equipment and resources as well as in customer support and service organization. On the other hand, those steps are involving a tremendous lot of money, and a small company has a hard task carrying this burden. It is said that a global player in a special commerce has to have a critical turnover mass of at least euro100m. Otherwise, such a company may be bleeding financially, leaving too little money on the table to develop their technology, or has to make too many compromises in its globalizing strategy, rendering some of the effort almost useless.

In this light it becomes obvi-ous that a lot of smaller companies can or will encounter problems, and in mid-term they are candidates for a merger, acquisition or a similar business settlement. Not every decision will eventually turn out to be successful. But things seem quite different in this Finish case: both Suomalainen companies are already listed on the Helsinki stock exchange, and their added profit rose to euro17.4m last year. The senior partner JOT is an euro100m-company with subsidiaries in eight countries around the globe, employing a staff of around 600. And junior partner PMJ (CEO Markku Jokela) reached net sales of more than euro40m, employing about 400 people and having run six subsidiaries. Just half a year ago, the acquisition of US-based depanneling specialist Cencorp was finished.

Strong together

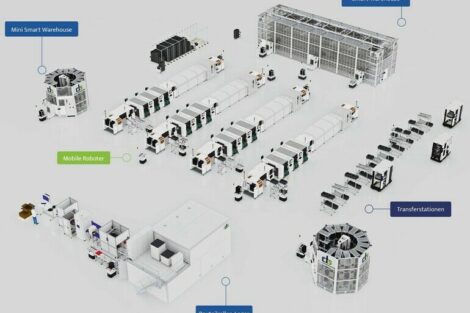

Together, JOT and PMJ will form an enterprise of more than 1000 people in coming fall, provided all legal affairs have been resolved sufficiently and the shareholders will agree. Their combined net sales growth amounted to 58% last year. So, taking a similar development for this year, the merged commerce can perform at nearly euro200m in net sales, and can be very profitable (even the merger and reorganization will inevitably consume some money). Together they will form the biggest one among the vendors of equipment for the automation in electronics production. Both companies are listed in the Helsinki stock exchange (hex.fi), and their market capitalization is a huge euro2.4bn fortuneaccording to the outstanding number of shares. The new enterprise will be then registered in the Helsinki main list. Some benefits are expected from the merger. First, it is synergy. About 5% annually cost reduction can be seen. Second, by combining business operations, resources of all kinds and the technological expertise in only one enterprise, an inter-nationally significant suppli-er of automation equipment will come into being, nota small Scandinavia-based player. Third, with the then very broad product portfolio, a further fast and profitable growth appears to be likely. Finally, a specialization by fabs and through increased equipment series can add to cost efficiency. The newly forged company should be able to ensure short lead times because, in this market, quick and right-time delivery is mandatory for success. Moreover, R&D will become even more effective, providing appropriate solutions for increasing requirements. Eventually, the merger can meet with the interest of customers, staff and shareholders alike. Gerhard B. Wolski

Fax+49-358284-84

www. jotautomation.com

EPP 154

Unsere Webinar-Empfehlung

Die Nutzung der 3D-Mess- und Prozessdaten bringt die Produktionssteuerung auf die nächste Stufe. Echte 3D-Messung ermöglicht KI-basierte Prozessmodellierung zur Vorhersage von Parameteränderungen und -defekten oder zur Ursachenanalyse bis hin zu einzelnen Werkzeugen und Best…

Teilen: